Supply Chain Cycle & Working Capital Finance

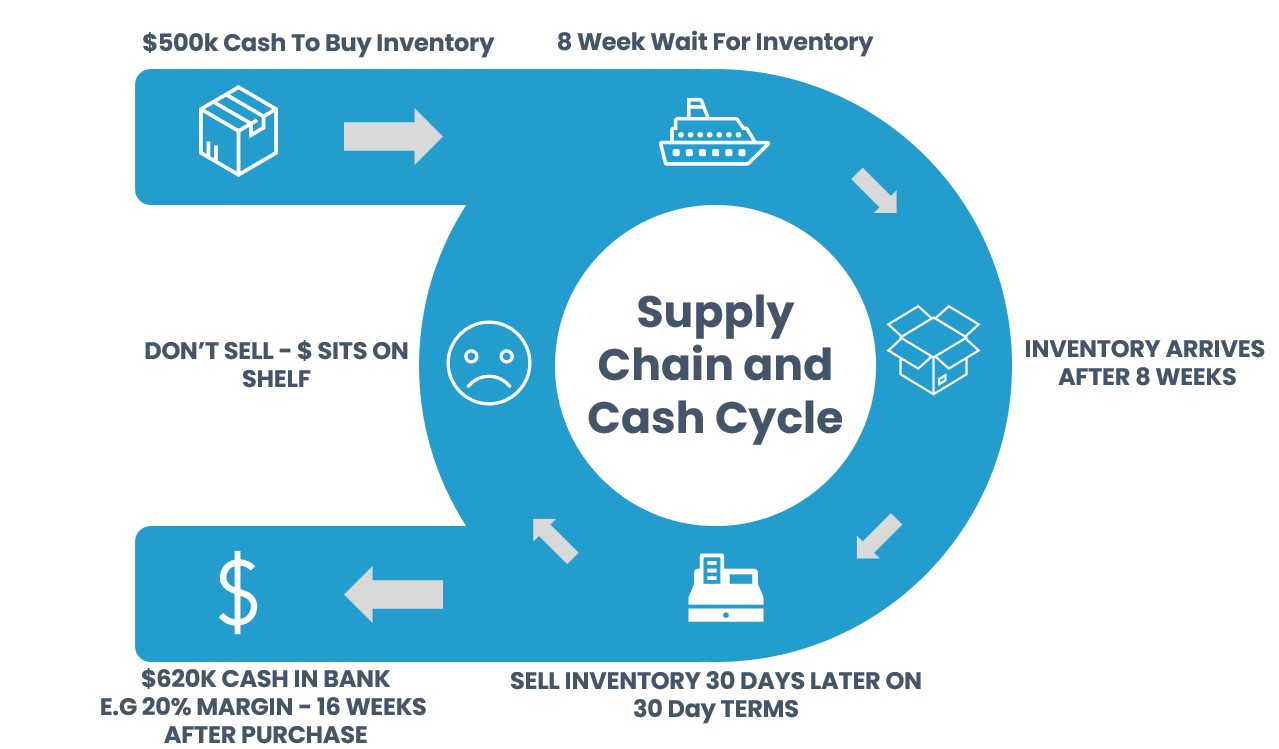

Effective management of the supply chain cycle is crucial to a successful business. The supply chain cycle is essentially a sequence of processes and activities involved in the production, distribution, and delivery of goods and services from suppliers to customers. It encompasses the entire journey of a product or service from its raw material sources to the end consumer. To help understand the cycle, here is a very simple example of a typical supply chain cycle for a wholesaling business:

The above example is further explained below:

- $500k cash invested to buy inventory.

- The inventory arrives 8 weeks after purchase assuming no delivery or delays (wishful thinking?).

- All stock is sold within 30 days on 30 day payment terms.

- Cash for the sale of the stock is received 4 months after paying for it.

- Assuming all clients pay within 30 days (also wishful thinking!?), the business has been drained of cash for a period of 4 months.

In the simple example outlined above, if the business started with only $500k, it has essentially $0 to pay staff, rent and invest in additional inventory until it receives the cash after 4 months. And in the likely event that everything does not go to plan and it either takes longer to receive the cash or all the stock isn’t sold, it is effectively cash sitting on the shelf.

Many high-growth clients experiencing rapid sales growth, or clients with businesses that are seasonally affected, have heard from their accountants, advisers and bankers to simply ‘stretch out your suppliers or collect your debtors more quickly.’ This is obviously a lot easier said than done, and can significantly impact customer & supplier relationships.

Often clients experiencing a never-ending cash drain from their supply chain cycle, or who struggle to operate efficiently with an existing bank overdraft, haven’t had the benefit of having an advisor independently sit down and understand their cash conversion cycle and determine where a working capital debt facility can ‘fill the gap.’ They are also likely to be unaware of numerous working capital facilities options available to businesses that have strong earnings and a healthy balance sheet – many of which do not need property as security. Facilities that are generally far better at assisting with managing their cash flow than a poorly structured overdraft which is secured by their property.

The Relationship between the Supply Chain Cycle and Working Capital

Efficient supply chain management can significantly impact a company’s working capital. The supply chain cycle and working capital are interconnected because how a company manages its supply chain can significantly impact its working capital position. Efficient supply chain management can help optimize inventory levels, cash flow, and the timing of payments, all of which play a crucial role in maintaining healthy working capital.

If this example sounds familiar to you or if you are an accountant and you see this scenario with one of your clients; reach out to us for a chat and let’s see if we can put together a solution or advise a better funding package around working capital options.